Icici credit card statement provides a detailed summary of your credit card transactions and outstanding balance. We will explore the features and benefits of reviewing your credit card statement, as well as the steps to access it.

Understanding your credit card statement is crucial for monitoring your spending, tracking rewards, and detecting any unauthorized charges. It also helps in managing your finances, making timely payments, and avoiding late fees. By accessing your icici credit card statement, you can stay informed about your transactions and maintain control over your financial activities.

Let’s delve into the process of accessing your statement and making the most of the information it provides.

Credit: www.amazon.in

The Importance Of Understanding Your Credit Card Statement

Understanding your credit card statement is crucial to effectively manage your finances, particularly the icici credit card statement. It provides vital information that helps you stay in control of your expenses and make informed financial decisions. By carefully analyzing the statement, you can track your spending habits, identify any unauthorized charges, and detect any errors or discrepancies.

It allows you to monitor your payment history, balance, and due dates, ensuring that you stay on top of your financial obligations. Additionally, the statement provides a breakdown of your transactions, giving you insights into your spending patterns and helping you budget more efficiently.

By regularly reviewing your icici credit card statement, you can proactively manage your finances and avoid unnecessary fees or penalties. Stay informed and keep your financial well-being on track through a thorough understanding of your credit card statement.

Decoding The Elements Of Your Icici Credit Card Statement

Your icici credit card statement contains various elements that require decoding for a better understanding. This includes analyzing the layout and format of the statement, as well as the different sections and their significance. Within the statement, you will find detailed information regarding your transactions, including the date, description, and amount of each transaction.

Additionally, you will also find your total outstanding balance, minimum amount due, and payment due date. Understanding these sections is essential for managing your finances effectively and staying on top of your credit card payments. By familiarizing yourself with the elements of your icici credit card statement, you can gain better control over your finances and ensure timely payments.

Key Terminology And Definitions For Icici Credit Card Statements

In order to comprehend the implications and impacts of each term, it is important to unravel the common terms used in the icici credit card statement. By understanding the key terminology and definitions associated with these statements, you can gain a clearer understanding of your financial transactions.

It is crucial to be aware of terms such as “minimum amount due,” “statement date,” “interest charges,” and “credit limit. ” These terms play a significant role in managing your credit card and ensuring timely payments. By familiarizing yourself with these terms, you can make informed decisions and effectively manage your finances.

Understanding your icici credit card statement empowers you to stay in control of your financial health and make the most of your credit card benefits.

Untangling The Charges And Fees On Your Icici Credit Card Statement

Untangling the charges and fees on your icici credit card statement can be a daunting task. It’s important to understand the different types of charges and their purposes to maintain good financial health. By carefully examining your statement, you can identify significant fees that may affect your finances.

Whether it’s an annual fee, late payment fee, or foreign transaction fee, each charge serves a specific purpose and understanding its implications is crucial. Analyzing your icici credit card statement allows you to better manage your expenses and make informed financial decisions.

Stay vigilant and always review your statement to avoid any surprises and ensure your financial well-being.

Enhancing Your Financial Management Skills With Icici Credit Card Statements

Enhance your financial management skills with icici credit card statements by using them to track your spending habits. These statements provide valuable information that can help you make informed decisions about your finances. By carefully reviewing your statement, you can identify where your money is going and where you may need to make adjustments.

Understanding your spending habits allows you to prioritize your expenses, save money, and achieve your financial goals. With icici credit card statements, you have access to detailed transaction information, including the date, location, and amount of each purchase. Take advantage of this valuable tool to improve your financial well-being and take control of your money.

Detecting Errors And Disputing Transactions On Your Icici Credit Card Statement

Detecting errors and disputing transactions on your icici credit card statement is crucial. It’s important to recognize any inaccuracies and inconsistencies in the statement. By following these steps, you can effectively dispute fraudulent or erroneous transactions. First, carefully review your statement to identify any suspicious or unfamiliar charges.

Next, gather documentation and evidence to support your claim, such as receipts or communication records. Then, contact icici customer service immediately to report the issue and initiate the dispute process. Be prepared to provide all necessary details and documentation to support your case.

Throughout the process, maintain open communication and follow up regularly to ensure resolution. Remember to stay vigilant and monitor your credit card statement regularly to prevent future discrepancies.

Maximizing Rewards And Benefits With Icici Credit Card Statements

Maximizing rewards and benefits with icici credit card statements involves examining the reward programs and incentives offered by icici credit cards. By utilizing the statement, cardholders can optimize their rewards and benefits. Taking a closer look at the rewards program allows cardholders to understand the different ways they can earn rewards, such as through points or cashback.

These rewards can be redeemed for a variety of options, including travel, shopping, or even statement credits. Additionally, the statement provides information about any ongoing promotions or offers that cardholders can take advantage of to further enhance their rewards and benefits.

It is important for cardholders to review their statement regularly to ensure they are aware of all the rewards and benefits available to them and to make the most of their icici credit card experience.

Securely Managing Your Icici Credit Card Statement

Managing your icici credit card statement securely is crucial to protect against fraudulent activities. Safeguard your personal information on the statement by following these tips. First, regularly monitor your statement for any suspicious or unauthorized transactions. Secondly, never share your statement details with anyone, especially over email or phone calls.

Thirdly, when it comes to accessing your statement online, use strong passwords and enable two-factor authentication for added security. Additionally, if you notice any discrepancies or fraudulent charges, immediately report them to the bank. Moreover, regularly update your contact information with the bank to ensure you receive notifications and alerts.

In addition, keep your physical statements stored securely and shred them before discarding. Following these guidelines will help safeguard your icici credit card statement and protect your personal information from fraudulent activities.

Leveraging Technology To Simplify The Icici Credit Card Statement Process

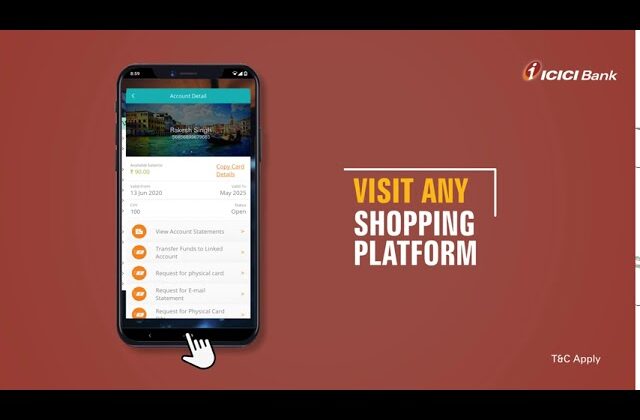

Technology has revolutionized the way we manage our icici credit card statements. Digital tools and apps have made it easier than ever to streamline the reviewing and payment process. With these innovative solutions, you can effortlessly keep track of your expenses and transactions.

Gone are the days of cumbersome paperwork and manual calculations. These digital tools provide real-time updates, allowing you to stay on top of your finances with just a few taps on your smartphone. Whether you need to check your balance, view your statement, or make a payment, these digital tools have got you covered.

Say goodbye to the hassle of paper statements and welcome the convenience of technology in managing your icici credit card statement.

Best Practices For Reviewing And Analyzing Your Icici Credit Card Statement

Reviewing and analyzing your icici credit card statement is crucial to maintain a healthy financial state. By establishing a systematic approach, you can ensure accurate assessment. Identify trends and patterns, such as spending habits or recurring charges, to make informed decisions.

This insight allows you to improve your overall financial health by identifying areas where you can cut expenses or alter spending behavior. Regularly reviewing your statement helps you stay on track with your financial goals and avoid any errors or fraudulent activity.

Take the time to thoroughly analyze each transaction and ensure they align with your budget and financial priorities. Adopting these best practices will enable you to effectively manage your icici credit card statement and make more informed financial decisions.

Frequently Asked Questions For Icici Credit Card Statement

How Can I Get My Icici Credit Card Statement?

To get your icici credit card statement, follow these simple steps: 1. Visit the icici bank website or open the imobile app on your smartphone. 2. Login to your account using your credentials. 3. Once logged in, navigate to the “credit card” section.

4. Look for the “statements” tab and click on it. 5. Select the specific month for which you want to view the statement. 6. Your icici credit card statement will be displayed on the screen. 7. You can also download or print the statement for your records.

By following these steps, you can easily access your icici credit card statement online. Remember to keep your login credentials safe and secure to protect your personal information.

How Can I Download Icici Credit Card Pdf Statement?

To download your icici credit card pdf statement, follow these easy steps: 1. Log in to your icici net banking account using your credentials. 2. On the dashboard, click on the “e-statement” or “view statement” option. 3. Select your credit card account from the drop-down menu.

4. Choose the desired period for which you want the statement and click on the “download pdf” button. 5. Save the pdf file to your desired location on your computer or mobile device. 6. Open the downloaded pdf file using a pdf reader to view or print your icici credit card statement.

By following these steps, you can easily and securely download your icici credit card pdf statement whenever you need it.

How Do I Get My Credit Card Statement Online?

To get your credit card statement online, follow these steps: 1. Log in to your online banking account. 2. Look for the credit card section or menu. 3. Click on the statement or statement download option. 4. Select the desired statement period and download it as a pdf or view it online.

Alternatively, 1. Visit your credit card issuer’s website. 2. Look for the login or sign-in option. 3. Enter your credentials to access your account. 4. Locate the statements or documents section. 5. Choose the statement you want to view or download.

Remember to keep your login details secure and check your statement regularly to monitor your spending and identify any unauthorized charges.

Can I Download Icici Bank Statement Online?

Yes, you can download your icici bank statement online. Just log in to your icici internet banking account and navigate to the ‘accounts’ section. From there, you can choose the account for which you need the statement. Look for the ‘statement’ tab and select the desired period for which you want the statement.

You will have the option to view or download the statement in pdf format. Make sure you have a pdf reader installed on your device to access the downloaded statement. It’s a convenient way to access your bank statement anytime and anywhere without having to visit a branch or contact the bank.

Remember to keep your login credentials safe and secure to protect your account information.

Conclusion

Managing your icici credit card statement can be a breeze with the right tools and knowledge. By understanding how to access your statement, reviewing it diligently, and resolving any discrepancies or fraudulent activities, you can ensure that your finances are in order and your credit health remains strong.

Utilizing the various online resources provided by icici bank, such as their mobile app and internet banking platform, makes it easier than ever to stay on top of your credit card transactions and payments. Remember to stay vigilant in monitoring your statement for any unauthorized charges and take immediate action to prevent any potential issues.

With these proactive steps, you can enjoy the benefits and convenience of your icici credit card while maintaining financial stability. Keep track of your spending, make timely payments, and achieve your financial goals with confidence.